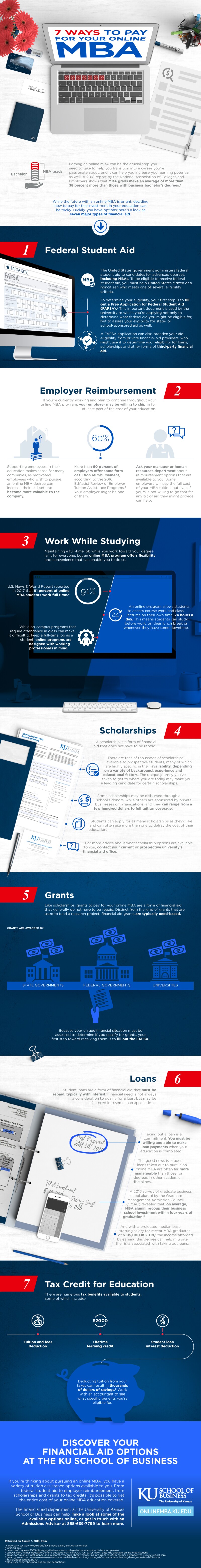

Earning an online MBA can be the crucial step you need to take to help you transition into a career you’re passionate about, and it can help you increase your earning potential as well. A 2018 report by the National Association of Colleges and Employers shows that MBA grads make an average of more than 38 percent more than those with business bachelor’s degrees.1

While the future with an online MBA is bright, deciding how to pay for this investment in your education can be tricky. Luckily, you have options; here’s a look at seven major types of financial aid.

1. Federal student aid

The United States government administers federal student aid to candidates for advanced degrees, including MBAs. To be eligible to receive federal student aid, you must be a United States citizen or a noncitizen who meets one of several eligibility criteria.

To determine your eligibility, your first step is to fill out a Free Application for Federal Student Aid (FAFSA).2 This important document is used by the university to which you’re applying not only to determine what federal aid you might be eligible for, but to assess your eligibility for state- or school-sponsored aid as well.

A FAFSA application can also broaden your aid eligibility from private financial aid providers, who might use it to determine your eligibility for loans, scholarships and other forms of third-party financial aid.

2. Employer reimbursement

If you’re currently working and plan to continue throughout your online MBA program, your employer may be willing to chip in for at least part of the cost of your education. Supporting employees in their education makes sense for many companies, as motivated employees who wish to pursue an online MBA degree can increase their skill set and become more valuable to the company.

More than 60 percent of employers offer some form of tuition reimbursement, according to the 2016 EdAssist Review of Employer Tuition Assistance Programs.3 Your employer might be one of them.

Ask your manager or human resources department about reimbursement options that are available to you. Some employers will pay the full cost of your MBA tuition, but even if yours is not willing to go that far, any bit of aid they might provide can help.

3. Work while studying

Maintaining a full-time job while you work toward your degree isn’t for everyone, but an online MBA program offers flexibility and convenience that can enable you to do so.

U.S. News & World Report reported in 2017 that 91 percent of online MBA students work full time.4 An online program allows students to access course work and class lectures on their own time, 24 hours a day. This means students can study before work, on their lunch break or whenever they have some downtime.

While on-campus programs that require attendance in class can make it difficult to keep a full-time job as a student, online programs are designed with working professionals in mind.

4. Scholarships

A scholarship is a form of financial aid that does not have to be repaid. There are tens of thousands of scholarships available to prospective students, many of which are highly specific in their availability, depending on a variety of background, experience and educational factors. The unique journey you’ve taken to get to where you are today may make you a leading candidate for certain scholarships.

Some scholarships may be disbursed through a school’s donors, while others are sponsored by private businesses or organizations, and they can range from a few hundred dollars to full tuition coverage. Students can apply for as many scholarships as they’d like and can often use more than one to defray the cost of their education.

For more advice about what scholarship options are available to you, contact your current or prospective university’s financial aid office.

5. Grants

Like scholarships, grants to pay for your online MBA are a form of financial aid that generally do not have to be repaid. Distinct from the kind of grants that are used to fund a research project, financial aid grants are typically need-based and are awarded by federal and state governments, as well as by universities themselves.

Because your unique financial situation must be assessed to determine if you qualify for grants, your first step toward receiving them is to fill out the FAFSA.

6. Loans

Student loans are a form of financial aid that must be repaid, typically with interest. Financial need is not always a consideration to qualify for a loan, but may be factored into some loan applications. Taking out a loan is a commitment. You must be willing and able to make loan payments when your education is completed.

The good news is, student loans taken out to pursue an online MBA are often far more manageable than those for degrees in other academic disciplines. A 2016 survey of graduate business school alumni by the Graduate Management Admission Council (GMAC) revealed that, on average, MBA alumni recoup their business school investment within four years of graduation.5 And with a projected median base starting salary for recent MBA graduates of $105,000 in 2018,6 the income afforded by earning this degree can help mitigate the risks associated with taking out loans.

7. Tax credit for education

There are numerous tax benefits available to students, some of which include:7

- Tuition and fees deduction

- Lifetime learning credit

- Student loan interest deduction

Deducting tuition from your taxes can result in thousands of dollars of savings.8 Work with an accountant to see what specific benefits you’re eligible for.

Discover Your Financial Aid Options at the KU School of Business

If you’re thinking about pursuing an online MBA, you have a variety of tuition assistance options available to you. From federal student aid to employer reimbursement, from scholarships and grants to tax credits, it’s possible to get the entire cost of your online MBA education covered.

The financial aid department at the University of Kansas School of Business can help. Take a look at some of the available options online, or get in touch with an Admissions Advisor at 855-639-7799 to learn more.

- Retrieved on August 1, 2018, from careerservices.wayne.edu/pdfs/2018-nace-salary-survey-winter.pdf

- Retrieved on August 1, 2018, from fafsa.ed.gov/

- Retrieved on August 1, 2018, from time.com/money/4305549/paying-their-workers-college-tuition-can-pay-off-for-companies/

- Retrieved on August 1, 2018, from usnews.com/higher-education/online-education/articles/2017-05-23/us-news-data-the-average-online-mba-student

- Retrieved on August 1, 2018, from gmac.com/market-intelligence-and-research/research-library/measuring-program-roi/2016-alumni-perspectives-survey-report.aspx

- Retrieved on August 1, 2018, from gmac.gcs-web.com/news-releases/news-release-details/mba-hiring-strong-4-5-companies-planning-hire-graduates-2018-mba

- Retrieved on August 1, 2018, from irs.gov/publications/p970

- Retrieved on August 1, 2018, from blog.visor.com/mba/mba-tuition-tax-deduction/